Description

Overview:

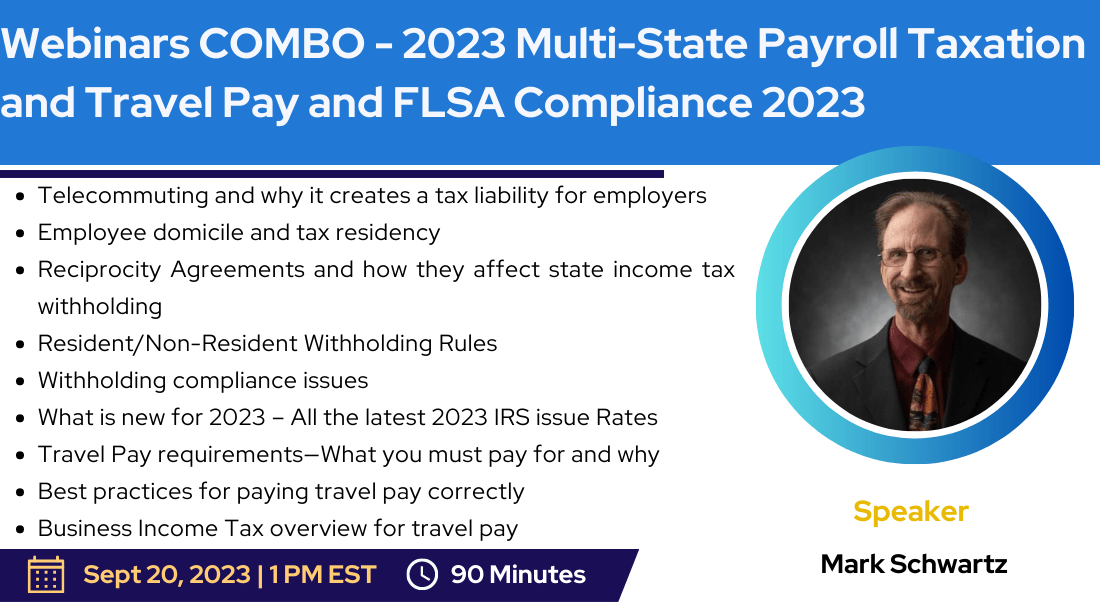

This is a bundle of two webinars of 90 Minutes each – (1) 2023 Multi-state Payroll Taxation, Nexus, Issues, & Withholding Requirements & (2) Travel Pay & FLSA Compliance 2023: New IRS Rates, 2023 Updates, Overview and simplification of Federal Taxation Rules

The On Demands and e-Transcripts are available instantly on concessional rates. These are downloadable and has lifetime validity.

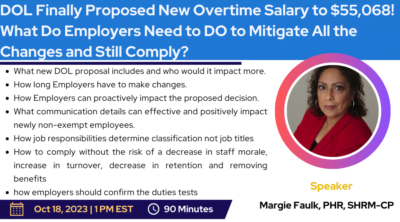

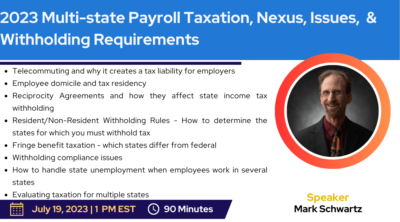

- 2023 Multi-state Payroll Taxation, Nexus, Issues, & Withholding Requirements

What happens when your company is located in one state and one or more of your employees work in another state? What if your company has multiple business locations, with employees in each? What happens when one or more of your employees performs services for your company in more than one state? The short answer: You have multi-state employment issues.

Having employees in more than one state creates a lot of headaches for both payroll and H/R managers alike. You must know the visiting state(s) rules for unemployment insurance, state income tax, and other state/local taxes. You have to understand when you must register as an employer in the visiting state; and withhold income tax for both states. Further, some states have reciprocal agreements to alleviate these burdens, but most don’t. Understanding how to calculate tax for employees in 2 or more states can be confusing. Plus, what state laws for payroll need to be followed when employing employees in more than one state.

- Travel Pay & FLSA Compliance 2023 : New IRS Rates and 2023 Updates

Most employers send workers out to travel for a variety of reasons. But most every worker commutes to the office. Perhaps they travel from home on dispatch. Businesses can ask workers to travel from the office during the day for sales/service calls, errands, shopping, etc. Longer term travel includes conferences, long distance sales calls, setting up stores, entertaining prospective clients and many other purposes.

The rules are many and varied. No one audio conference could possibly explain all of them. Limits and other rules are updated every year. However, basic rules of thumb can be applied to travel pay, similar to rules of thumb for all fringe benefits.

What areas will be covered in these two webinars:

- 2023 Multi-State Taxation

- Telecommuting and why it creates a tax liability for employers

- Employee domicile and tax residency

- Reciprocity Agreements and how they affect state income tax withholding

- Resident/Non-Resident Withholding Rules – How to determine the states for which you must withhold tax

- Withholding compliance issues

- Evaluating taxation for multiple states

- What wages are subject to taxation?

- Withholding compliance issues.

- State Unemployment Insurance; SUTA dumping – what it is and how to avoid this penalty trap

- Traveling Employees

- Administrative Concerns & HR Concerns

- Travel Pay & FLSA Compliance 2023

- What is new for 2023 – All the latest 2023 IRS issue Rates

- Travel Pay requirements—What you must pay for and why

- Best practices for paying travel pay correctly

- Business Income Tax overview for travel pay

- Accountable Plans – How to avoid all expense reimbursements becoming taxable wages to your workers.

- The FLSA and its requirements including compensable time

- The “tax home” designation and the difference between short and long-term travel

- Per Diems and how they can make life easier for employers and employees alike.

- Meals and Entertainment – how these are often abused by employees and employers. Know the rules before getting red-flagged by the IRS.

- Transportation expenses – how short-term travel is regulated

- A/P vs payroll communication – crucial for compliance

WHO SHOULD ATTEND:

- Payroll Executives/Managers/Administrators/Professionals/Practitioners/Entry Level Personnel

- Human Resources Executives/Managers/Administrators

- Accounting Personnel

- Business Owners/Executive Officers/Operations and Departmental Managers

- Lawmakers

- Attorneys/Legal Professionals

- Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues

- Compensation and hiring staff

- Finance and Operational managers

- Executive Staff