Description

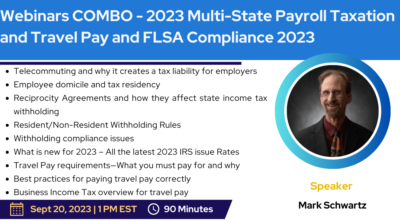

The Fair Labor Standards Act (FLSA) already poses complex challenges, and the Department of Labor just released a critical update to its overtime regulations that goes into effect in June 2024: increases the minimum annual salary amount to $43,888 plus another increase to $58,656 on Jan. 1, 2025. This webinar is designed to guide employers through the necessary changes to maintain for compliance with these new rules. We’ll explore the key adjustments affecting employee classifications, particularly the new annual salary amount and the implications of transitioning employees from exempt to non-exempt statuses—a shift that could significantly increase your overtime liabilities.

What You will Learn:

Key Areas Covered During the Webinar:

- Comprehensive breakdown of the proposed changes to the overtime rules: a detailed analysis of the FLSA exemption and overtime updates, the June 2024 salary amount, the January 2025 salary amount, and future amounts.

- Understanding the new criteria for exempt status, including the Duties Test and Salary Level Test adjustments.

- Strategies for reclassifying employees considering the new rules, focusing on “white-collar” exemptions.

- Examination of changes specific to Highly Compensated Employees under the revised regulations.

- Best practices for ensuring your employees are correctly classified to comply with the forthcoming FLSA 2024 overtime regulations.

Why You should Attend:

Why Attending This Webinar Is Essential: Stay ahead of significant regulatory changes that could affect your payroll and legal costs. Equip yourself with knowledge to conduct an FLSA compliance review effectively. Understand the ramifications of non-compliance and how to safeguard your organization. Join us to navigate these essential updates with confidence and ensure your practices align with the new legal requirements.

Who should Attend:

- All Employers

- Business Owners

- Company Leadership

- Compliance professionals

- Payroll Administrators

- HR Professionals

- Managers/Supervisors

- Anyone Interested in Being Compliant with Current Regulations