Description

HRCI & SHRM Approved Webinar | CEUs = 1.0 Credit Hour

Overview:

Big Reform. Bigger Stakes. The One Big Beautiful Bill Act (OBBB), signed into law on July 4, 2025, isn’t just historic—it’s transformational. From tax-free overtime to sweeping Medicaid changes, every employer needs to prepare for what’s next.

Join us for a high-impact, 60-minute briefing tailored for HR professionals, business owners, and decision-makers. You’ll walk away with a clear understanding of what’s changed, what’s still protected (like employer-sponsored health coverage), and what steps you need to take now. Whether you manage people, process payroll, oversee benefits, or drive strategy—you need to know what’s in the OBBB to protect your organization and empower your workforce.

Navigate the new tax and benefits landscape. Protect your workforce strategy and stay compliant. Make sense of nearly 900 pages of legislation—fast.

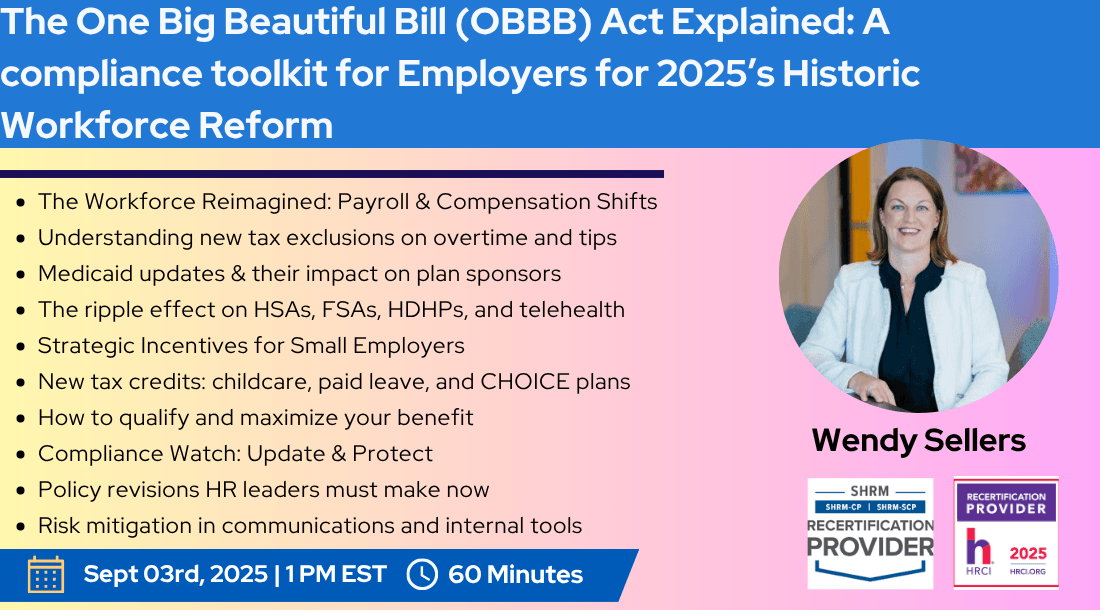

What will You Learn:

- The Workforce Reimagined: Payroll & Compensation Shifts

- Understanding new tax exclusions on overtime and tips

- Myths & misunderstandings: common employer pitfalls

- Health & Welfare Plans in Flux

- Medicaid updates & their impact on plan sponsors

- The ripple effect on HSAs, FSAs, HDHPs, and telehealth

- Strategic Incentives for Small Employers

- New tax credits: childcare, paid leave, and CHOICE plans

- How to qualify and maximize your benefit

- Compliance Watch: Update & Protect

- Policy revisions HR leaders must make now

- Risk mitigation in communications and internal tools

Why Attend This Webinar?

The One Big Beautiful Bill Act (OBBB) is the most significant workforce legislation in decades, and it’s already reshaping employer responsibilities for payroll, healthcare, compliance, and tax strategy. In just 60 minutes, you’ll:

- Decode how tax-free overtime and tip exclusions impact your payroll processes

- Understand the Medicaid and health plan reforms affecting your employee benefits

- Learn how to qualify for new tax credits tied to paid leave, childcare, and small business incentives

- Get actionable steps to update policies, avoid penalties, and stay compliant in 2025 and beyond

Who should Attend:

- HR Managers & HR Directors

- Chief Human Resource Officers (CHROs)

- Payroll Managers & Compensation Specialists

- Benefits Administrators & Total Rewards Managers

- Finance Directors & Chief Financial Officers (CFOs)

- Legal & Compliance Officers

- Operations Managers & COOs

- Business Owners & Entrepreneurs

- Healthcare Plan Administrators

- Tax Advisors & Consultants

- Public Accountants & CPAs