Description

The 941 is a common form known to any employer. However it is anything but simple. Because it records all subject payments to employees, and provides credits for things such as the Employee Retention Credit, employers and the third-party payroll processors have to keep track of updates every year. The most recent credits are for the ERC, and have been available for several years. But this is ending, so find out how to claim free money before it is too late.

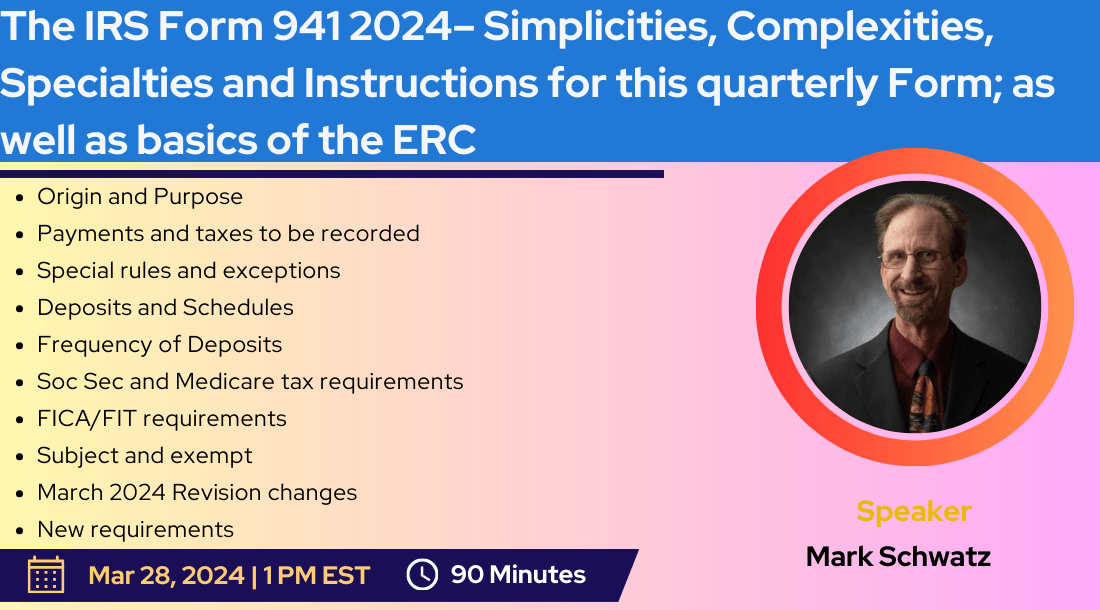

What will you Learn:

- Origin and Purpose

- Meant to be a reconciliation form for quarterly wages and deposits

- Payments and taxes to be recorded

- Special rules and exceptions

- Deposits and Schedules – Frequency of Deposits

- Soc Sec and Medicare tax requirements – Subject and Exempt

- FICA/FIT requirements – Subject and Exempt

- March 2024 Revision changes

- New requirements

- Reminders

- Special Circumstances

- 941 Section by Section

- ERC Summary – Who applies; which quarters still apply; and requirements

- Common Errors

Why you should Attend:

The bigger the business you are, the more complex your compensation structure, and whether or not you use a third party, you should know about the details of this form. It’s difficulty makes it easy to make mistakes. Mistakes are easily caught by the IRS. So ask yourself the following questions:

- Does my payroll system adequately record all taxable compensation to all workers – especially executives, traveling worker’s expenses, fringe benefits, etc.?

- Are deposits accurate and on time?

- Do you take advantage of credits available to you for the “Emergency of the Year” that applies to you?

- How frequently are 941x’s required for your business?

- Would it be beneficial to use a 3rd party in order to avoid “red flags” that can mean audits or reviews

Duration – 90 Minutes

Who should Attend:

- Payroll Processors

- HR Processors

- HR & Payroll Managers

- Accountants

- Financial Reporters

- Third party Payroll Processors