Description

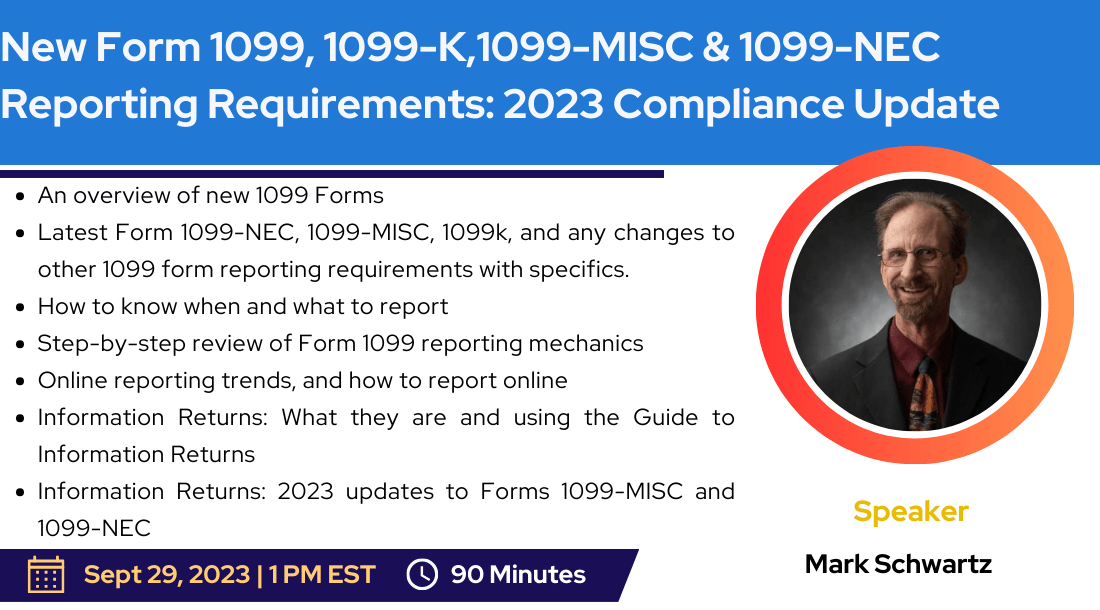

Duration – 90 Minutes | Speaker – Mark Schwartz

Overview:

1099s report payments made to non-employee service providers, as well as payments to suppliers and other entities you do business with. Think of your own organization: Can you name all the types of service providers you use? Do you know which payments are reportable on 1099s, and the minimum amounts you must pay before they are reportable?

There is a new 1099-k threshold for tax year 2023. The IRS is beefing up technology and staff to enhance enforcement to reduce the tax gap including actively targeting enforcement measures on information reporting compliance. Penalties for non-compliance are now indexed and increase each year. It is more important than ever that 1099 Forms be prepared correctly, filed, and furnished timely, and that filers perform due diligence procedures to avoid or mitigate penalties. The 1099-k will now require third party payment processors like venmo, paypal, google-pay and apple-pay to report all payments over 600 made to you and me. This is down from the previous threshold of $20,000.

Needless to say, this new check and balance will require most individual taxpayers, and any companies who use these services, to monitor all payments from all sources, and make sure that they are reported. Note that these payments were always reportable as taxable income. The difference is the IRS will know exactly who paid you and how much. They are now reporting same as the W2, 1099-NEC and other 1099s. Attend this live webinar to find out exactly what this means for your business. This webinar will cover the reporting requirements for Forms 1099-MISC and 1099-NEC with a focus on the details and proper preparation of the forms. It will also cover changes to the 2023 Forms and 2023/2024 and beyond electronic filing methods and requirements. This will include anticipated decreases in the e-file thresholds that will affect most filers and IRIS (Information Return Intake System) a new online portal for filing forms in the 1099 series.

What You will Learn:

- An overview of new 1099 Forms

- Latest Form 1099-NEC, 1099-MISC, 1099k, and any changes to other 1099 form reporting requirements with specifics.

- How to know when and what to report

- Step-by-step review of Form 1099 reporting mechanics

- Online reporting trends, and how to report online

- Information Returns: What they are and using the Guide to Information Returns

- Information Returns: 2023 updates to Forms 1099-MISC and 1099-NEC

- Reporting and filing requirements for 2023 returns filed in 2024

- Forms 1099-MISC, 1099-NEC, and 1096: Identification of reportable payments and payees

- Common 1099 errors – how to prevent them and how to correct them

- Taxpayer identification number basics: Which number to use

- Form W-9: documentation that establishes reportable and non-reportable payees

- Due diligence procedures avoid or mitigate penalties

- Penalties for late or incorrect 1099 Forms

- Procedures and policies that establish “reasonable cause” and avoid penalties

Why You should Attend:

The IRS is beefing up technology and staff to enhance enforcement to reduce the tax gap including actively targeting enforcement measures on information reporting compliance. Penalties for non-compliance are now indexed and increase each year. It is more important than ever that 1099 Forms be prepared correctly, filed, and furnished timely, and that filers perform due diligence procedures to avoid or mitigate penalties.

This webinar will cover the latest updates for Form 1099-MISC and Form 1099-NEC. It will cover specific reporting requirements for various types of payments and payees, filing requirements, withholding requirements, and reporting guidelines as well as the latest filing methods.

The webinar will touch on filing due dates, penalties for late-filed and late-furnished returns, best practices for the prevention and mitigation of penalties, and penalty exceptions. including how to establish reasonable cause for penalty abatement.

After attending this webinar, you will know

- How to develop an efficient Form 1099 reporting process

- Best practice to minimize penalties using proper policies and procedures that work under new rules

- How to determine if a worker is an independent contractor or an employee

- Form 1099 relationship to B-Notices (CP2100) and TIN Penalty Assessments (972CG)

- And much more…

Who should Attend:

- CFOs

- Controllers

- Accounts payable

- Accounting managers

- Accounts payable processing professionals

- Employers & Business owners

- Purchasing managers and professionals

- Public accountants

- CPAs

- Enrolled Agents