Description

Whether a worker is an independent contractor, or an employee is one of the most misunderstood areas in employment law, leaving businesses very vulnerable to fines, penalties and legal fees that can be staggering—particularly to smaller businesses. Businesses that try to escape payroll and other taxes in connection with their workers or providing workers’ compensation coverage and other benefits do so at their peril. Since this practice results in loss of significant sums of money to both the federal and state governments, the US Department of Labor has entered into agreements with many of its state counterparts to crack down on businesses that misclassify workers.

The DOL has announced a new rule regarding the classification of individuals as independent contractors that goes into effect from March 11, 2024. Employers may find it difficult to properly classify workers as independent contractors or employees due to these changes. The Department of Labor (DOL) independent contractor rule involves a new test with a different approach to classify workers, which could present challenges. Businesses should be prepared to adapt to remain compliant.

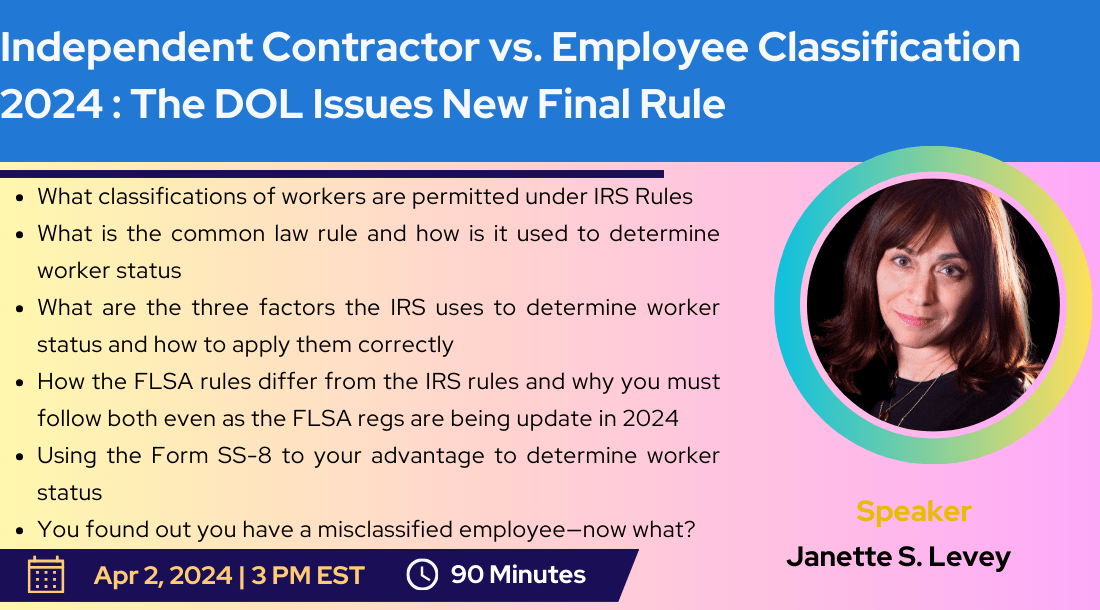

What will You Learn:

- DOL’s New 2024 Rules that goes into effect from March 11, 2024

- What classifications of workers are permitted under IRS Rules

- What is the common law rule and how is it used to determine worker status

- What are the three factors the IRS uses to determine worker status and how to apply them correctly

- How the FLSA rules differ from the IRS rules and why you must follow both even as the FLSA regs are being update in 2024

- How does the state trump both the IRS and the FLSA on determining independent contractor status with the ABC test for SUI

- What are the latest agreements or programs being used by the IRS, DOL and the states to “find” misclassified employees

- Using the Form SS-8 to your advantage to determine worker status

- What are the penalties for misclassifying an employee as an independent contractor and who assesses them.

- You found out you have a misclassified employee—now what?

Duration – 90 Minutes

Why you should Attend:

Misclassifying employees and independent contractors are getting costlier by the day. With federal and state agencies joining forces to combat misclassification, fines and penalties have skyrocketed. And every day the misclassification continues the penalties mount up and up until this ticking time bomb finally explodes!

This webinar will provide valuable and practical insight on how to properly classify freelancers, consultants, temps and other contract workers—and how to tell whether the worker in question an employee is really. In this webinar, you will learn how and when your workers are legally your employees, or what be able to properly classify them as independent contractors. This topic is particularly timely considering the Biden Administration’s withdrawal of the rule promulgated by the Trump Administration.

Who should Attend:

- Business Owners

- CEO’s

- CFO’s

- Controllers

- R. Managers and Directors

- Managers, Senior Managers

- Hiring Managers

- Anyone who deals with compensation issues.

- Compensation Officers

- Benefits Administrators

- HR Generalists