Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$290.00$185.00-$385.00

Employees v/s Independent Contractors : W-2s vs. 1099s – Who Should be an Independent Contractor in 2025

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$290.00$185.00-$385.00

DO’s & DON’Ts of Documenting Employee Behaviour, Discipline, Performance – Withstanding Legal Challenges

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$290.00$185.00-$385.00

Employee Handbooks 2025 : From the PUMP Act to Stericycle – What you need to know for 2025

Select options

This product has multiple variants. The options may be chosen on the product page

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$290.00$185.00-$385.00

Fringe Benefits 2025 Guide – Keeping a Happy Workforce while Not incurring unnecessary Payroll and Income Tax Expenses

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$290.00$185.00-$385.00

Leave Abuse under FMLA, ADA and Workers Comp: How Employers Can Deal with the Most Outrageous Excuses

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$295.00$185.00-$385.00

OSHA 2024 Recordkeeping Requirement For Electronic 300A – What Are Compliance Violations If You Missed the Deadlines!

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$290.00$185.00-$385.00

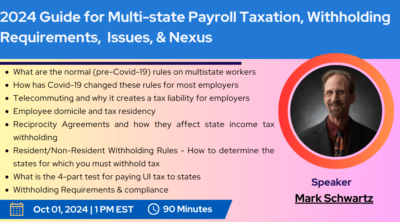

2024 Guide for Multi-state Payroll Taxation, Withholding Requirements, Issues, & Nexus

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$290.00$185.00-$385.00

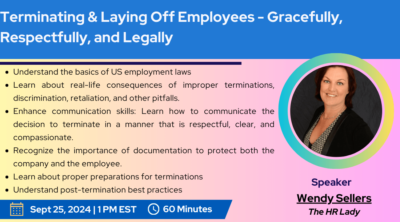

Terminating & Laying Off Employees – Gracefully, Respectfully, and Legally

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$675.00$185.00-$925.00

DO’s & DON’Ts of Documenting Employee Behaviour, Performance & Discipline – How to Withstand Legal Challenges

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$290.00$185.00-$385.00

Pay Equity Changes for 2024 : EEOC Requirements and NLRB Guidelines

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$290.00$185.00-$385.00

DOL’s 2024 New Overtime Rules for Exempt v/s Non-Exempt Employee: Mastering the Rules for 2024 and Beyond!

Select options

This product has multiple variants. The options may be chosen on the product page

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$290.00$185.00-$385.00

DOL’s New Final Rule on Independent Contractor v/s Employee Status – Benefits & Drawbacks : W-2s v/s 1099s

Select options

This product has multiple variants. The options may be chosen on the product page

$185.00-$290.00$185.00-$385.00