Description

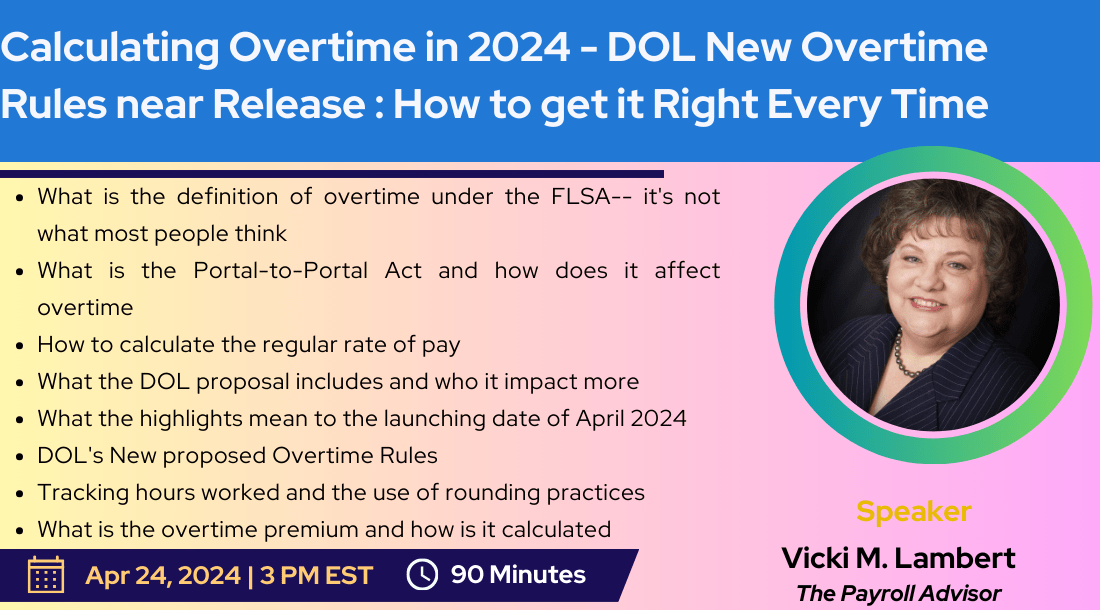

A Department of Labor (DOL) proposed rule increasing the minimum salary threshold for exempt employees is projected to change the exempt status of approximately 3.4 million employees and DOL plans to finalize Rule by April 2024 & go into effect as early as June 2024.

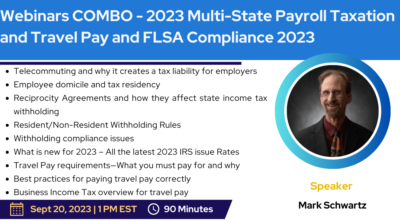

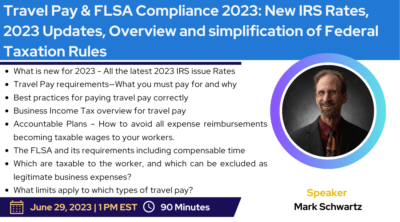

Calculating overtime pay for non-exempt employees sounds so simple. Common folk lore says you simply count the hours the employee works beyond 40 hours a week. Then you multiply that by 1.5 times their hourly pay rate and you’re done right? Not so fast. The truth is that overtime rules and the mathematics required to arrive at the correct calculation can be extremely tricky. Overtime under the Fair Labor Standards Act is based on a unique term, created in 1938, known as the regular rate of pay. And calculating the regular rate of pay is more complex than it appears. What’s included in the calculation? The reasonable cost of meals, lodging, nondiscretionary bonuses, commissions, on-call pay, shift differentials, cash benefit payments from Section 125 Cafeteria Plans, the list goes on… And that’s just computing the regular rate – we haven’t even touched overtime yet! For example, when a bonus must be included in calculating the rate what overtime does it apply to? When the bonus is paid or when the bonus was earned? What if the bonus spans a long period of time such as a quarter or a full year?

Then what happens if you get it wrong? Nobody pays attention, do they? According to the Department of Labor they collected more than $230 million in back wages for more than 190,000 workers in FY 2021 alone. Of that amount collected, $138 million was for back overtime.

What will You Learn:

- What is the definition of overtime under the FLSA– it’s not what most people think

- What is the Portal-to-Portal Act and how does it affect overtime

- How to calculate the regular rate of pay

- What the DOL proposal includes and who it impact more

- What the highlights mean to the launching date of April 2024

- DOL’s New proposed Overtime Rules

- Tracking hours worked and the use of rounding practices

- The eight narrowly construed exceptions to inclusion of payments in the regular rate

- When you must include a bonus in calculating your employee’s overtime pay

- What is the overtime premium and how is it calculated

- How to calculate overtime if a bonus covers more than one workweek

- Using the weighted average method to calculate overtime when and where it must be done

- When and how to use the “fluctuating workweek”

- When can the “alternate” method of calculating overtime be used

Why you should Attend:

The DOL plans to finalize the rule by April 2024, meaning the new rule could take effect as soon as June 2024. Accordingly, employers should prepare to respond to the increased minimum threshold for exempt employees.

This webinar discusses how to calculate overtime under the FLSA rules for non-exempt employees. Includes definitions of overtime and calculation examples. Penalties for overtime violations can be severe with the possibility of fines, imprisonment or both! Add civil suits to the mix and the results can be devastating to any business no matter how large or small! And just to make it interesting, most states use the same definition to calculate overtime as the FLSA does. So, one error can earn you double the penalties.

Who should Attend:

- Payroll Executives/ Managers/ Administrators/ Professionals/ Practitioners/ Entry Level Personnel

- Human Resources Executives/ Managers/Administrators

- Accounting Personnel

- Business Owners/ Executive Officers/ Operations and Departmental Managers

- Lawmakers

- Attorneys/ Legal Professionals

- Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues