Description

SHRM & HRCI Approved Webinar | CEUs = 1.5 Credits Hours

Overview:

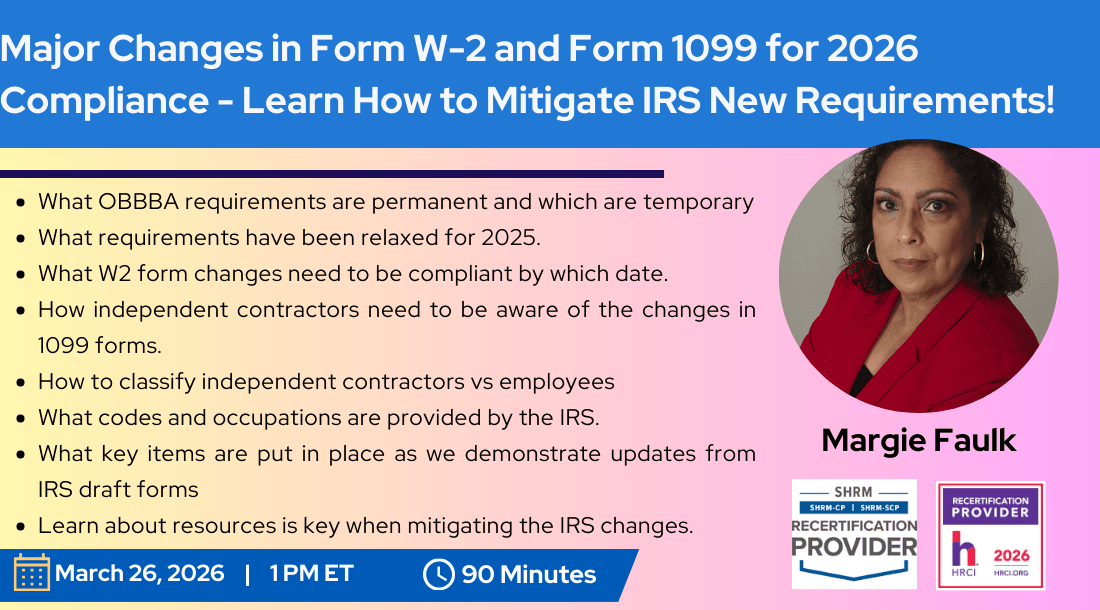

Major updates for 2026 W-2 and Form 1099 are being introduced under the “One Big Beautiful Bill Act” (OBBBA), including an increased 1099 reporting threshold and new reporting codes on the W-2 Form for tips and overtime. These updates must be part of your compliance efforts. The changes will impact not only your payroll taxes but also the independent contractors protocol.

The One Big Beautiful Bill Act (OBBBA) has over 900 pages of provisions that are temporary and permanent. This has impacted organizations nationwide. The OBBB Act instructs the IRS to update the applicable income tax withholding procedures and tax forms to reflect this new deduction and required occupation listing.

There are many challenges and confusion for Employers and employees on what needs to be done with these IRS changes. This training will outline the changes and compliance efforts that need to be put in place to avoid fines, penalties, and criminal sanctions.

What will You Learn:

- What OBBBA requirements are permanent and which are temporary

- What requirements have been relaxed for 2025.

- What Form W-2 changes need to be compliant by which date.

- How independent contractors need to be aware of the changes in 1099 forms.

- How to classify independent contractors vs employees

- What codes and occupations are provided by the IRS.

- What key items are put in place as we demonstrate updates from IRS draft forms

- Learn about resources is key when mitigating the IRS changes.

- How to communicate these changes to employees effectively to meet compliance guidelines.

- How your tax provider must be part of your team to assess how you are impacted as a company and as an individual.

Why you should Attend:

IRS has provided documents to prepare Employers on the list of changes that have to be in place for 2026. They have also provided changes to some of the requirements due for 2025, which has confused about which requirements supersede. We will provide a step-by-step approach to ensuring compliance based on the IRS requirements. We will also offer resources that will help mitigate some of the challenges for 2025 and beyond.

Who should Attend:

- All Employers

- Business Owners

- Company Leadership

- Compliance professionals

- HR Professionals

- Managers/Supervisors